Featured Companies

- 1. DuPont de Nemours, Inc

- 2. Shaw Industries Group, Inc.

- 3. Tarkett S.A.

- 4. Victoria Plc

- 5. Controlled Products, LLC

- 6. Act Global

- 7. Sport Group

- 8. Mondo S.p.A.

- 9. SIS Pitches

- More...

Artificial turf is a man-made surface that is designed to resemble natural grass surfaces. The grass on artificial turfs is composed of polymer fibres such as polyethylene, polypropylene, and polyamides, the use of which is determined by their properties. Artificial turfs have been shown to have a low environmental impact because they are recyclable, require less water, and use fewer pesticides and fertilisers. Because of their excellent durability, cheap maintenance, outstanding quality, all-weather utility, virtual appeal, and eco-friendliness, these turfs are commonly employed as sports pitches. These turfs can also be used in the leisure and landscaping industries. Demand for appealing Artificial Turfs in gated communities and societies have boded well for the business. In urban societies, urban homeowners are more likely to spend money on lawns and playgrounds. Moreover, these facilities are often considered imperative to the aesthetic value of any property. Artificial turfs are gaining appeal in residential applications as they prevent the interaction of toxic pesticides and fertilisers used on natural grass. As artificial turfs and other flooring materials evolve, industry players are increasingly emphasising the use of cost-effective manufacturing techniques and biodegradable materials such as polylactic acid (PLA) fibre types to offer eco-efficient solutions. Moreover, the emergence of customised and recyclable products is expected to create lucrative sales opportunities for manufacturers. In recent years, most of the leading market players have invested in research and development initiatives, contributing to the invention of numerous innovative products. As an example, Ten Cate Grass, a global pioneer in synthetic grass solutions for sports and landscaping, announced the acquisition of Synthetic Grass Warehouse in April 2017. As an artificial turf supplier, the acquisition will help the company become a key player in the rapidly increasing landscaping industry. AstroTurf, an American subsidiary of SportGroup, announced the acquisition of Nagle Athletic Surfaces Inc. in August 2019. Because Nagle Athletic Surfaces, Inc. has a diverse product line, this technique has assisted AstroTurf in extending their product portfolio.

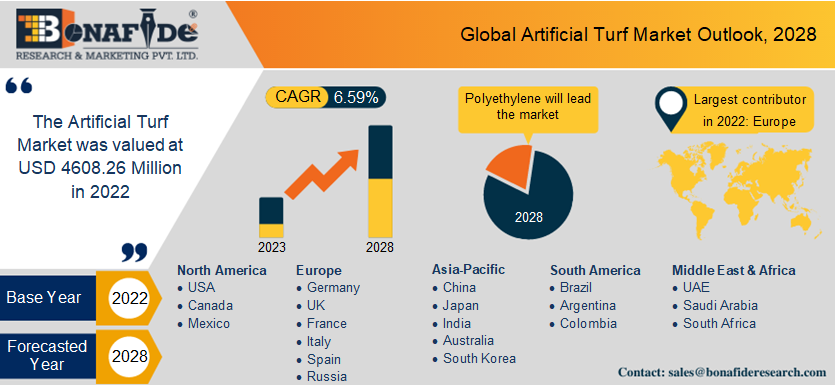

According to the research report, "Global Artificial Turf Market Outlook, 2028," published by Bonafide Research, the market is projected to cross 6710 million in size, increasing from 4608.26 million in 2022. The market is expected to grow at a 6.59% CAGR by 2023–28. The growing number of hotels, restaurants, and airports around the world is likely to fuel the business. Artificial turf is rapidly being employed in these infrastructures for a variety of purposes, including beautifying balconies, swimming pools, and rooftops. As a result of the on-going expansion in the hospitality industry, the market for artificial turf is expected to grow steadily. The market is likely to be driven by the increasing popularity of sports events for games such as football, cricket, hockey, golf, and others, as well as forthcoming global sports events. As a result, the market will benefit from an increase in the number of international sporting events, such as football and cricket matches, among others. Artificial turfs are progressively used for preparing fields that host these sports, as they are more durable and do not lose their sheen even after years. With major sports events such as Football Champion League matches, the Hockey Junior Pan American Championship 2021, and others, the demand for artificial turf has skyrocketed over the years. Manufacturers are developing new turfs with shock cushions, anti-bacterial qualities, and natural components such as cork, crumb driver, and rubber zest to lower the chances of injuries with the emergence of hybrid artificial turf technology and third-generation turfs. These advancements are projected to provide a favourable environment for overall market growth. Artificial turfs perform best in contact sports like football and rugby, two of the most popular sports in and around Europe. Many new artificial turfs are being installed for soccer and rugby grounds, with the most prominent development being the use of artificial turfs in the FIFA Women's World Cup and the FIFA World Cup.

What's Inside a Bonafide Research`s industry report?

A Bonafide Research industry report provides in-depth market analysis, trends, competitive insights, and strategic recommendations to help businesses make informed decisions.

Download Sample

Based on the report, the Europe region led the overall global market in 2022 and is projected to continue this dominance in the upcoming time frame. The presence of a large number of sports fields, switching trends from natural grass to synthetic grass, and increasing popularity of outdoor sports are expected to maintain market growth for artificial turf in the region. The number of stadiums and sports activities is high in the region. The increase in research and development activities for artificial grass due to the safety concerns of sports players, government support for the maintenance of artificial grass facilities, and infrastructure to promote sports activities, mainly football, is expected to drive the market in this region during the forecast period. The presence of a huge number of sports arenas and stadiums and the rising popularity of sports among the younger generation are some of the major factors driving the growth of the market in the region. According to obtained data, in 2018, there were around 91,000 sports clubs running in Germany, and this number is expected to reach 100,000 by 2023. Europe, Asia, and North America are expected to witness increasing demand for artificial turf during the forest period, owing to the increasing number of stadiums in these regions. According to the Union of European Football Associations (UEFA) and the Stadium Managers Association, Europe has the highest number of stadiums, at over 1220. Based on the country segmentation, the United States will dominate the market in 2022. On-going expansion of the construction industry is expected to bolster the market in the U.S. Artificial turfs are gaining popularity in construction projects for sports arenas, residences, stadiums, and commercial gardens since they are more durable and require less upkeep than genuine grass.

The market has been divided into three segments based on fibre base materials: polyethylene, polypropylene, and nylon. Artificial grass made from polyethylene materials held the greatest share of the market in terms of both volume and revenue in 2022 and is expected to maintain its dominance during the forecast period. Superior product attributes, including durability, softness, and resilience, contribute to their rising popularity in end-user applications. Polypropylene-based artificial turfs are known for their extended lifespan and reduced prices, and as a result, they will account for a substantial proportion of consumption in 2022. However, factors such as the harshness of the product on skin, lower resistance to heat, and less durability have restricted its growth in major outdoor sports applications, which, in turn, is hampering the overall market growth. Polyethylene grass is perfect for front and backyard applications, sports, and pets owing to its softness, realism, and absence of moisture absorption. On January 26, 2021, Smart Turf introduced a variety of athletic turf products treated with Microban for health and sports clubs, as well as athletic stadiums. The new product line, developed for businesses across the country looking for solutions to increased concerns about cleanliness and improved safety measures in fitness, sports, and athletic facilities, introduces the first athletic artificial turf product with built-in antimicrobial protection. However, nylon has the second-biggest market share because of features such as UV radiation resistance, heat resistance, and a substantially longer colour life. Furthermore, developments in materials for long colour retention, high melting points, and wear resistance are expected to fuel artificial turf market expansion.

Artificial turf demand is rising due to increased sporting events and competitions and unfavourable environmental conditions for optimal natural grass growth. In addition, governments of various nations are investing heavily in infrastructure development projects to build new commercial gardens, sports facilities, and stadiums. The sports segment held the largest market share based on end users. There is high demand for artificial turf due to its easy maintenance and increased playing time in the sports industry. Furthermore, the development of high-quality artificial turf products by players approved by various bodies, such as the Federation Internationale de Football Association (FIFA), is credited with market growth. The artificial turf market is predicted to grow rapidly because of low maintenance requirements and increasing demand from the sports and residential sectors. A significant increase in sporting activities, as well as poor meteorological conditions for natural grass growth, is driving up demand for artificial turf in the sports industry. For example, CC Grass constructed artificial grass on Dingyuan County Sports Centre's football pitch, and Anhui received FIFA Quality Pro Certification in 2022. There is also high demand for artificial turf in the residential and commercial application sectors. With various advantages, artificial turf is a valid substitute for lawns. Artificial turf is simple to use, especially inside and outside. They will never break because they are UV-resistant, and they will function efficiently and comfortably for a very long time as they are highly durable. It can be used for a very long time if maintained properly. Further, various developed and developing countries are experiencing rapid urbanisation, leading to significant construction sector growth globally and, thereby, fuelling low-maintenance product demand, especially artificial turf.

Among contact sports, non-contact sports, leisure, and landscaping, contact sports are expected to dominate the segment, accounting for the largest market share. Rising participation of the young population in outdoor sports such as football, rugby, and cricket across the globe is creating scope for the construction of new stadiums and sports fields, in turn propelling the industry's growth. On the other hand, leisure applications are witnessing higher market growth. With more and more areas across the globe being affected by drought, maintaining a lush lawn has become an expensive affair. Also, the rising awareness of environmental degradation has led people to reduce the use of chemical-based fertilisers and pesticides. With designers and architects always coming up with new methods to employ synthetic grass, it has made its way into everyone's life. Furthermore, because petroleum infill is more robust and shock-resistant, it is increasingly being employed in artificial turf for outdoor sporting applications like golf courses, rugby fields, football fields, and cricket grounds. The growing popularity of sports events and the increasing number of stadiums across the globe are propelling the sales of rubber infill. Also, sports events such as the ICC Cricket World Cup 2031 and the Qatar FIFA World Cup 2022 are expected to provide lucrative sales opportunities for the rubber infill. However, plant-based infill is derived from plants and is increasingly gaining momentum as a substitute for rubber granule infill. This infill type recycles and helps preserve the artificial grass's medium temperatures, which are significantly lower than the artificial turf with rubber-based infill. Companies are also engaged in R&D and are attempting to introduce sustainable or plant-based artificial turf.

Based on installation, the market has been segmented into flooring and wall cladding. In 2022, the flooring segment dominated the market in terms of both value and volume. In 2022, the flooring segment dominated the market in terms of both value and volume. Rising popularity and acceptance of synthetic sports fields, along with extended applications in landscaping, are the key factors that drive the flooring segment in the artificial grass market. In developed countries, the backing of advanced technologies with regard to product development and sports infrastructure development has fuelled the demand for artificial grass. On the other hand, artificial turf is also increasingly being used over walls in various places, including gardens, villas, sites, and others, to cover walls for border security. Several restaurants and cafes are enhancing their interiors and exteriors by installing artificial turf over walls, thereby supporting market growth. On the basis of back coatings, the polyurethane segment is dominating the market, with a market size of over $2800 million in 2022. Polyurethane back coatings are commonly used in artificial turf products as they provide several benefits, such as durability, water resistance, and improved overall performance. The global artificial turf market based on polyurethane back coatings is expected to grow in the coming years due to increasing demand for artificial turf in various applications such as sports fields, landscaping, and commercial spaces. On the other hand, latex back coatings have been a popular choice for artificial turf products for many years due to their excellent bonding properties and flexibility. Latex back coatings are expected to contribute significantly to the growth of the market. Some of the key players operating in the global artificial turf market based on latex back coatings include Tarkett, SportGroup Holding, Shaw Industries Group, Inc., Victoria PLC, SIS Pitches, ForestGrass, ACT Global Sports, Limonta Sport, Domo Sports Grass, and Controlled Products, LLC. These companies are focused on product innovation and development to enhance the performance and durability of artificial turf products, including those with latex back coatings. They are also investing in research and development activities to develop eco-friendly and sustainable artificial turf products.

According to the report, the market is segmented into direct sales (B2B), online stores, specialty stores, and others. Among them, the direct sales/B2B segment will dominate the market in 2022 with higher revenue generation. This segment's growth is being driven by factors such as greater reach in places with poor connectivity and high consumer trust connected with touching and experiencing the quality of products. Although the online channel has a smaller proportion of the artificial turf market, it is predicted to develop at the fastest CAGR throughout the forecast period. The proliferation of e-commerce and raising awareness of the benefits of online purchases, such as heavy discounts, occasional offers, the availability of several coupon codes, and rising demand for convenience, are driving the growth of the online segment. Online purchasing, mobile ordering, and digital media are all part of Internet multichannel campaigns. During the projected period, online multichannel platforms are expected to have high penetration rates. Vendors are also expected to expand their online presence through e-commerce platforms and partnerships with other e-commerce companies. Some of the common online platforms for artificial turf include Amazon, Home Depot, Wayfair, Global Syn-Turf, Synthetic Grass Warehouse, etc.

Fourth-generation (4G) artificial turfs are a recent breakthrough in the worldwide artificial turf business. This turf is currently in its early phases of development and does not need filler material. Some of the key advantages of this breakthrough include the absence of toxic compounds, improved durability, the absence of additional microplastics, and one-step recycling. Manufacturers widely offer artificial turfs of various sizes and types in order to meet the diverse needs of clients. For example, in June 2020, SynLawn Artificial Grass, a major manufacturer and creator of artificial grass, developed a product line of the safest and cleanest turf that employs advanced super yarn technology as well as other sanitised additives in its material to prevent infection from the grass to the user. Artificial turf has come a long way since its introduction in the 1960s. Advancements in technology have allowed for the development of more durable, realistic, and sustainable artificial turf products. For instance, 3D fibre technology involves weaving fibres in different directions to create a more realistic look and feel of natural grass. This technology also improves the durability and longevity of artificial turf products. Antimicrobial coatings are applied to artificial turf products to prevent the growth of bacteria and other microorganisms. This technology is particularly useful for sports fields and playgrounds where there is a high risk of infection. Furthermore, smart turf is a new technology that incorporates sensors into artificial turf products to monitor and analyse the performance of athletes. This technology can provide valuable data on the biomechanics of athletes and help prevent injuries. Cool fibre technology involves adding reflective particles to the fibres of artificial turf products to reduce the surface temperature. This technology helps prevent overheating and makes the surface more comfortable for athletes to play on.

Recent Developments:

• In May 2022, SYNLawn, the leading manufacturer and unrivalled innovator of artificial grass in North America, announced that the company, through SYNLawn Southern Nevada, would expand their service to the Reno and Las Vegas areas after a long number of years of successfully operating in the Southern Nevada.

• In September 2022, Sentinel Capital Partners, a private equity firm that invests in promising and reliable mid-market companies, announced their acquisition of the Recreational Group, a leading manufacturer of recreational surfacing products.

• September 2021: In the Netherlands, Crestview Partners acquired TenCate Grass Holding BV, the leading global artificial grass solutions provider for sports and landscaping.

• On June 27, 2022, Elite Turf, a global artificial grass company, introduced the POWER System, which is partially made from recycled ocean plastics and was developed in partnership with Adidas and ClearChoice infill. This eco-friendly artificial grass removes 4,000 lbs. of plastic from the ocean per field and is fully recyclable from top to bottom. It is 28 degrees cooler than standard turf fields, which increases foot stability and traction and also leads to fewer injuries. It does not contain any heavy materials or carcinogens and is EN 71-3 toy safety standard and United States Department of Agriculture (USDA) approved.

Covid-19 Impacts:

The extraordinary coronavirus outbreak has had a severe impact on artificial grass sales. Sports events and building operations were forced to halt due to severe regulations and lockdown enforced by the governments of over 160 countries, limiting the sale of artificial grass during the pandemic period. Various countries' economies and sectors were affected by the pandemic. The exceptional surge in COVID-19 cases, followed by the closure of major manufacturing sites, influenced the expansion of several markets. The Middle East and Africa's distribution networks were severely interrupted, affecting artificial turf sales. Nonetheless, the convenience of lockdown, the growing number of construction projects, and increased application in residential and commercial sectors are projected to drive the artificial turf market in the coming years. The artificial turf market is anticipated to experience an increase in demand as the globe gets ready for the impending COVID-19 pandemic. Many people are looking to buy artificial turf as a way of protecting their homes and families due to worries about the health of those who will be exposed to the virus.

Major Companies present in the market:

DuPont de Nemours, Inc., Tarkett Inc., Victoria PLC, Controlled Products, LLC, Act Global, Sport Group, Mondo S.p.A., SIS Pitches, Tiger lily, Global Syn-Turf Inc, ForeverLawn Inc., IntegriTurf, LLC, Condor Grass, TenCate Grass, CoCreation Grass Co., Ltd, Nurteks Hali, K&B Junwoo Co. Ltd, Shandong Biyuan Artificial turf co., Ltd, Shaw Industries Group Inc., Limonta Sport

Considered in this report

• Geography: Global

• Historic year: 2017

• Base year: 2022

• Estimated year: 2023

• Forecast year: 2028

Aspects covered in this report

• Global Artificial Turf market with its value and forecast along with its segments

• Region-wise Artificial Turf market analysis

• Various drivers and challenges

• On-going trends and developments

• Top profiled companies

• Strategic recommendation

Regions & Countries covered in the report:

• North America (United States, Canada, Mexico)

• Europe (Germany, United Kingdom, France, Spain, Italy, Russia)

• Asia-Pacific (China, Japan, India, Australia, South Korea)

• South America (Brazil, Argentina, Colombia)

• Middle-East & Africa (UAE, Saudi Arabia, South Africa)

By Fiber Base Material

• Polyethylene

• Nylon

• Polypropylene

By End Users

• Sports

• Residential

• Commercial

By Infill Material

• Petroleum Based

• Sand Based

• Plant Based

By Distribution Channel

• Direct Sales / B2B

• Specialty Stores

• Online Stores

• Others

By Application

• Contact Sports

• Non-Contact Sports

• Leisure

• Landscaping

By Grass Backing

• Polyurethane

• Latex

By Installation Type

• Flooring

• Wall Cladding

The approach of the report:

This report consists of a combined approach of primary as well as secondary research. Initially, secondary research was used to get an understanding of the market and listing out the companies that are present in the market. The secondary research consists of third party sources such as press releases, annual report of companies, analyzing the government generated reports and databases. After gathering the data from secondary sources primary research was conducted by making telephonic interviews with the leading players about how the market is functioning and then conducted trade calls with dealers and distributors of the market. Post this we have started doing primary calls to consumers by equally segmenting consumers in regional aspects, tier aspects, age group, and gender. Once we have primary data with us we have started verifying the details obtained from secondary sources.

Intended audience

This report can be useful to industry consultants, manufacturers, suppliers, associations & organizations related to Artificial Turf industry, government bodies and other stakeholders to align their market-centric strategies. In addition to marketing & presentations, it will also increase competitive knowledge about the industry.

Companies Mentioned

- DuPont de Nemours, Inc

- Shaw Industries Group, Inc.

- Tarkett S.A.

- Victoria Plc

- Controlled Products, LLC

- Act Global

- Sport Group

- Mondo S.p.A.

- SIS Pitches

- Tiger lily

- Global Syn-Turf Inc

- ForeverLawn Inc.

- IntegriTurf, LLC

- Condor Grass

- TenCate Grass

- CoCreation Grass Co., Ltd

- Nurteks Hali

- K&B Junwoo Co. Ltd

- Shandong Biyuan Artificial turf co., Ltd

- Limonta Sport

Table of Contents

- Table of Contents

- 1. Executive Summary

- 2. Market Dynamics

- 2.1. Market Drivers

- 2.2. Challenges

- 2.3. Opportunity

- 2.4. Restraints

- 2.5. Market Trends

- 2.6. Covid-19 Effect

- 2.7. Supply chain Analysis

- 2.8. Policy & Regulatory Framework

- 2.9. Industry Experts Views

- 3. Research Methodology

- 3.1. Secondary Research

- 3.2. Primary Data Collection

- 3.3. Market Formation & Validation

- 3.4. Report Writing, Quality Check & Delivery

- 4. Market Structure

- 4.1. Market Considerate

- 4.2. Assumptions

- 4.3. Limitations

- 4.4. Abbreviations

- 4.5. Sources

- 4.6. Definitions

- 5. Economic /Demographic Snapshot

- 6. Competitive Landscape

- 6.1. Competitive Dashboard

- 6.2. Business Strategies Adopted by Key Players

- 6.3. Key Players Market Share Insights and Analysis, 2022

- 6.4. Key Players Market Positioning Matrix

- 6.5. Consolidated SWOT Analysis of Key Players

- 6.6. Porter's Five Forces

- 7. Global Artificial Turf Market Outlook

- 7.1. Market Size By Value

- 7.2. Market Size and Forecast, By Geography

- 7.3. Market Size and Forecast, By Fiber Base Material

- 7.4. Market Size and Forecast, By End Users

- 7.5. Market Size and Forecast, By Infill Material

- 7.6. Market Size and Forecast, By Distribution Channel

- 7.7. Market Size and Forecast, By Application

- 7.8. Market Size and Forecast, By Back Coatings

- 7.9. Market Size and Forecast, By Installation Type

- 8. North America Artificial Turf Market Outlook

- 8.1. Market Size By Value

- 8.2. Market Share By Country

- 8.3. Market Size and Forecast By Fiber Base Material

- 8.4. Market Size and Forecast By End Users

- 8.5. Market Size and Forecast By Infill Material

- 8.6. Market Size and Forecast By Distribution Channel

- 8.7. Market Size and Forecast By Application

- 8.8. US Artificial Turf Market Outlook

- 8.8.1. Market Size By Value

- 8.8.2. Market Size and Forecast By Fiber Base Material

- 8.8.3. Market Size and Forecast By End Users

- 8.8.4. Market Size and Forecast By Infill Material

- 8.8.5. Market Size and Forecast By Distribution Channel

- 8.9. Canada Artificial Turf Market Outlook

- 8.9.1. Market Size By Value

- 8.9.2. Market Size and Forecast By Fiber Base Material

- 8.9.3. Market Size and Forecast By End Users

- 8.9.4. Market Size and Forecast By Infill Material

- 8.9.5. Market Size and Forecast By Distribution Channel

- 8.10. Mexico Artificial Turf Market Outlook

- 8.10.1. Market Size By Value

- 8.10.2. Market Size and Forecast By Fiber Base Material

- 8.10.3. Market Size and Forecast By End Users

- 8.10.4. Market Size and Forecast By Infill Material

- 8.10.5. Market Size and Forecast By Distribution Channel

- 9. Europe Artificial Turf Market Outlook

- 9.1. Market Size By Value

- 9.2. Market Share By Country

- 9.3. Market Size and Forecast By Fiber Base Material

- 9.4. Market Size and Forecast By End Users

- 9.5. Market Size and Forecast By Infill Material

- 9.6. Market Size and Forecast By Distribution Channel

- 9.7. Market Size and Forecast By Application

- 9.8. Germany Artificial Turf Market Outlook

- 9.8.1. Market Size By Value

- 9.8.2. Market Size and Forecast By Fiber Base Material

- 9.8.3. Market Size and Forecast By End Users

- 9.8.4. Market Size and Forecast By Infill Material

- 9.8.5. Market Size and Forecast By Distribution Channel

- 9.9. UK Artificial Turf Market Outlook

- 9.9.1. Market Size By Value

- 9.9.2. Market Size and Forecast By Fiber Base Material

- 9.9.3. Market Size and Forecast By End Users

- 9.9.4. Market Size and Forecast By Infill Material

- 9.9.5. Market Size and Forecast By Distribution Channel

- 9.10. France Artificial Turf Market Outlook

- 9.10.1. Market Size By Value

- 9.10.2. Market Size and Forecast By Fiber Base Material

- 9.10.3. Market Size and Forecast By End Users

- 9.10.4. Market Size and Forecast By Infill Material

- 9.10.5. Market Size and Forecast By Distribution Channel

- 9.11. Italy Artificial Turf Market Outlook

- 9.11.1. Market Size By Value

- 9.11.2. Market Size and Forecast By Fiber Base Material

- 9.11.3. Market Size and Forecast By End Users

- 9.11.4. Market Size and Forecast By Infill Material

- 9.11.5. Market Size and Forecast By Distribution Channel

- 9.12. Spain Artificial Turf Market Outlook

- 9.12.1. Market Size By Value

- 9.12.2. Market Size and Forecast By Fiber Base Material

- 9.12.3. Market Size and Forecast By End Users

- 9.12.4. Market Size and Forecast By Infill Material

- 9.12.5. Market Size and Forecast By Distribution Channel

- 9.13. Russia Artificial Turf Market Outlook

- 9.13.1. Market Size By Value

- 9.13.2. Market Size and Forecast By Fiber Base Material

- 9.13.3. Market Size and Forecast By End Users

- 9.13.4. Market Size and Forecast By Infill Material

- 9.13.5. Market Size and Forecast By Distribution Channel

- 10. Asia-Pacific Artificial Turf Market Outlook

- 10.1. Market Size By Value

- 10.2. Market Share By Country

- 10.3. Market Size and Forecast By Fiber Base Material

- 10.4. Market Size and Forecast By End Users

- 10.5. Market Size and Forecast By Infill Material

- 10.6. Market Size and Forecast By Distribution Channel

- 10.7. Market Size and Forecast By Application

- 10.8. China Artificial Turf Market Outlook

- 10.8.1. Market Size By Value

- 10.8.2. Market Size and Forecast By Fiber Base Material

- 10.8.3. Market Size and Forecast By End Users

- 10.8.4. Market Size and Forecast By Infill Material

- 10.8.5. Market Size and Forecast By Distribution Channel

- 10.9. Japan Artificial Turf Market Outlook

- 10.9.1. Market Size By Value

- 10.9.2. Market Size and Forecast By Fiber Base Material

- 10.9.3. Market Size and Forecast By End Users

- 10.9.4. Market Size and Forecast By Infill Material

- 10.9.5. Market Size and Forecast By Distribution Channel

- 10.10. India Artificial Turf Market Outlook

- 10.10.1. Market Size By Value

- 10.10.2. Market Size and Forecast By Fiber Base Material

- 10.10.3. Market Size and Forecast By End Users

- 10.10.4. Market Size and Forecast By Infill Material

- 10.10.5. Market Size and Forecast By Distribution Channel

- 10.11. Australia Artificial Turf Market Outlook

- 10.11.1. Market Size By Value

- 10.11.2. Market Size and Forecast By Fiber Base Material

- 10.11.3. Market Size and Forecast By End Users

- 10.11.4. Market Size and Forecast By Infill Material

- 10.11.5. Market Size and Forecast By Distribution Channel

- 10.12. South Korea Artificial Turf Market Outlook

- 10.12.1. Market Size By Value

- 10.12.2. Market Size and Forecast By Fiber Base Material

- 10.12.3. Market Size and Forecast By End Users

- 10.12.4. Market Size and Forecast By Infill Material

- 10.12.5. Market Size and Forecast By Distribution Channel

- 11. South America Artificial Turf Market Outlook

- 11.1. Market Size By Value

- 11.2. Market Share By Country

- 11.3. Market Size and Forecast By Fiber Base Material

- 11.4. Market Size and Forecast By End Users

- 11.5. Market Size and Forecast By Infill Material

- 11.6. Market Size and Forecast By Distribution Channel

- 11.7. Market Size and Forecast By Application

- 11.8. Brazil Artificial Turf Market Outlook

- 11.8.1. Market Size By Value

- 11.8.2. Market Size and Forecast By Fiber Base Material

- 11.8.3. Market Size and Forecast By End Users

- 11.8.4. Market Size and Forecast By Infill Material

- 11.8.5. Market Size and Forecast By Distribution Channel

- 11.9. Argentina Artificial Turf Market Outlook

- 11.9.1. Market Size By Value

- 11.9.2. Market Size and Forecast By Fiber Base Material

- 11.9.3. Market Size and Forecast By End Users

- 11.9.4. Market Size and Forecast By Infill Material

- 11.9.5. Market Size and Forecast By Distribution Channel

- 11.10. Columbia Artificial Turf Market Outlook

- 11.10.1. Market Size By Value

- 11.10.2. Market Size and Forecast By Fiber Base Material

- 11.10.3. Market Size and Forecast By End Users

- 11.10.4. Market Size and Forecast By Infill Material

- 11.10.5. Market Size and Forecast By Distribution Channel

- 12. Middle East & Africa Artificial Turf Market Outlook

- 12.1. Market Size By Value

- 12.2. Market Share By Country

- 12.3. Market Size and Forecast By Fiber Base Material

- 12.4. Market Size and Forecast By End Users

- 12.5. Market Size and Forecast By Infill Material

- 12.6. Market Size and Forecast By Distribution Channel

- 12.7. Market Size and Forecast By Application

- 12.8. UAE Artificial Turf Market Outlook

- 12.8.1. Market Size By Value

- 12.8.2. Market Size and Forecast By Fiber Base Material

- 12.8.3. Market Size and Forecast By End Users

- 12.8.4. Market Size and Forecast By Infill Material

- 12.8.5. Market Size and Forecast By Distribution Channel

- 12.9. Saudi Arabia Artificial Turf Market Outlook

- 12.9.1. Market Size By Value

- 12.9.2. Market Size and Forecast By Fiber Base Material

- 12.9.3. Market Size and Forecast By End Users

- 12.9.4. Market Size and Forecast By Infill Material

- 12.9.5. Market Size and Forecast By Distribution Channel

- 12.10. South Africa Artificial Turf Market Outlook

- 12.10.1. Market Size By Value

- 12.10.2. Market Size and Forecast By Fiber Base Material

- 12.10.3. Market Size and Forecast By End Users

- 12.10.4. Market Size and Forecast By Infill Material

- 12.10.5. Market Size and Forecast By Distribution Channel

- 13. Company Profile

- 13.1. DuPont de Nemours, Inc.

- 13.1.1. Company Snapshot

- 13.1.2. Company Overview

- 13.1.3. Financial Highlights

- 13.1.4. Geographic Insights

- 13.1.5. Business Segment & Performance

- 13.1.6. Product Portfolio

- 13.1.7. Key Executives

- 13.1.8. Strategic Moves & Developments

- 13.2. Tarkett Inc

- 13.3. Victoria PLC

- 13.4. Controlled Products, LLC

- 13.5. Act Global

- 13.6. Sport Group

- 13.7. Mondo S.p.A.

- 13.8. SIS Pitches

- 13.9. Tiger lily

- 13.10. Global Syn-Turf Inc

- 13.11. ForeverLawn Inc.

- 13.12. IntegriTurf, LLC

- 13.13. Condor Grass

- 13.14. TenCate Grass

- 13.15. CoCreation Grass Co., Ltd

- 13.16. Nurteks Hali

- 13.17. K&B Junwoo Co. Ltd

- 13.18. Shandong Biyuan Artificial turf co., Ltd

- 13.19. Shaw Industries Group Inc.

- 13.20. Limonta Sport

- 14. Strategic Recommendations

- 15. Annexure

- 15.1. FAQ`s

- 15.2. Notes

- 15.3. Related Reports

- 16. Disclaimer

Table 1: Global Artificial Turf Market Snapshot, By Segmentation (2022 & 2028) (in USD Million)

Table 2: Influencing Factors for Global Artificial Turf Market, 2022

Table 3: Top 10 Counties Economic Snapshot 2020

Table 4: Economic Snapshot of Other Prominent Countries 2020

Table 5: Average Exchange Rates for Converting Foreign Currencies into U.S. Dollars

Table 6: Global Artificial Turf Market Size and Forecast, By Geography (2017 to 2028F) (In USD Million)

Table 7: Global Artificial Turf Market Size and Forecast, By Fiber Base Material (2017 to 2028F) (In USD Million)

Table 8: Global Artificial Turf Market Size and Forecast, By End Users (2017 to 2028F) (In USD Million)

Table 9: Global Artificial Turf Market Size and Forecast, By Infill Material (2017 to 2028F) (In USD Million)

Table 10: Global Artificial Turf Market Size and Forecast, By Distribution Channel (2017 to 2028F) (In USD Million)

Table 11: Global Artificial Turf Market Size and Forecast, By Application (2017 to 2028F) (In USD Million)

Table 12: Global Artificial Turf Market Size and Forecast, By Back Coatings (2017 to 2028F) (In USD Million)

Table 13: Global Artificial Turf Market Size and Forecast, By Installation Type (2017 to 2028F) (In USD Million)

Table 14: North America Artificial Turf Market Size and Forecast By Fiber Base Material (2017 to 2028F) (In USD Million)

Table 15: North America Artificial Turf Market Size and Forecast By End Users (2017 to 2028F) (In USD Million)

Table 16: North America Artificial Turf Market Size and Forecast By Infill Material (2017 to 2028F) (In USD Million)

Table 17: North America Artificial Turf Market Size and Forecast By Distribution Channel (2017 to 2028F) (In USD Million)

Table 18: North America Artificial Turf Market Size and Forecast By Application (2017 to 2028F) (In USD Million)

Table 19: US Artificial Turf Market Size and Forecast By Fiber Base Material (2017, 2022 & 2028F)

Table 20: US Artificial Turf Market Size and Forecast By End Users (2017, 2022 & 2028F)

Table 21: US Artificial Turf Market Size and Forecast By Infill Material (2017, 2022 & 2028F)

Table 22: US Artificial Turf Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 23: Canada Artificial Turf Market Size and Forecast By Fiber Base Material (2017, 2022 & 2028F)

Table 24: Canada Artificial Turf Market Size and Forecast By End Users (2017, 2022 & 2028F)

Table 25: Canada Artificial Turf Market Size and Forecast By Infill Material (2017, 2022 & 2028F)

Table 26: Canada Artificial Turf Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 27: Mexico Artificial Turf Market Size and Forecast By Fiber Base Material (2017, 2022 & 2028F)

Table 28: Mexico Artificial Turf Market Size and Forecast By End Users (2017, 2022 & 2028F)

Table 29: Mexico Artificial Turf Market Size and Forecast By Infill Material (2017, 2022 & 2028F)

Table 30: Mexico Artificial Turf Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 31: Europe Artificial Turf Market Size and Forecast By Fiber Base Material (2017 to 2028F) (In USD Million)

Table 32: Europe Artificial Turf Market Size and Forecast By End Users (2017 to 2028F) (In USD Million)

Table 33: Europe Artificial Turf Market Size and Forecast By Infill Material (2017 to 2028F) (In USD Million)

Table 34: Europe Artificial Turf Market Size and Forecast By Distribution Channel (2017 to 2028F) (In USD Million)

Table 35: Europe Artificial Turf Market Size and Forecast By Application (2017 to 2028F) (In USD Million)

Table 36: Germany Artificial Turf Market Size and Forecast By Fiber Base Material (2017, 2022 & 2028F)

Table 37: Germany Artificial Turf Market Size and Forecast By End Users (2017, 2022 & 2028F)

Table 38: Germany Artificial Turf Market Size and Forecast By Infill Material (2017, 2022 & 2028F)

Table 39: Germany Artificial Turf Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 40: UK Artificial Turf Market Size and Forecast By Fiber Base Material (2017, 2022 & 2028F)

Table 41: UK Artificial Turf Market Size and Forecast By End Users (2017, 2022 & 2028F)

Table 42: UK Artificial Turf Market Size and Forecast By Infill Material (2017, 2022 & 2028F)

Table 43: UK Artificial Turf Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 44: France Artificial Turf Market Size and Forecast By Fiber Base Material (2017, 2022 & 2028F)

Table 45: France Artificial Turf Market Size and Forecast By End Users (2017, 2022 & 2028F)

Table 46: France Artificial Turf Market Size and Forecast By Infill Material (2017, 2022 & 2028F)

Table 47: France Artificial Turf Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 48: Italy Artificial Turf Market Size and Forecast By Fiber Base Material (2017, 2022 & 2028F)

Table 49: Italy Artificial Turf Market Size and Forecast By End Users (2017, 2022 & 2028F)

Table 50: Italy Artificial Turf Market Size and Forecast By Infill Material (2017, 2022 & 2028F)

Table 51: Italy Artificial Turf Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 52: Spain Artificial Turf Market Size and Forecast By Fiber Base Material (2017, 2022 & 2028F)

Table 53: Spain Artificial Turf Market Size and Forecast By End Users (2017, 2022 & 2028F)

Table 54: Spain Artificial Turf Market Size and Forecast By Infill Material (2017, 2022 & 2028F)

Table 55: Spain Artificial Turf Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 56: Russia Artificial Turf Market Size and Forecast By Fiber Base Material (2017, 2022 & 2028F)

Table 57: Russia Artificial Turf Market Size and Forecast By End Users (2017, 2022 & 2028F)

Table 58: Russia Artificial Turf Market Size and Forecast By Infill Material (2017, 2022 & 2028F)

Table 59: Russia Artificial Turf Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 60: Asia-Pacific Artificial Turf Market Size and Forecast By Fiber Base Material (2017 to 2028F) (In USD Million)

Table 61: Asia-Pacific Artificial Turf Market Size and Forecast By End Users (2017 to 2028F) (In USD Million)

Table 62: Asia-Pacific Artificial Turf Market Size and Forecast By Infill Material (2017 to 2028F) (In USD Million)

Table 63: Asia-Pacific Artificial Turf Market Size and Forecast By Distribution Channel (2017 to 2028F) (In USD Million)

Table 64: Asia-Pacific Artificial Turf Market Size and Forecast By Application (2017 to 2028F) (In USD Million)

Table 65: China Artificial Turf Market Size and Forecast By Fiber Base Material (2017, 2022 & 2028F)

Table 66: China Artificial Turf Market Size and Forecast By End Users (2017, 2022 & 2028F)

Table 67: China Artificial Turf Market Size and Forecast By Infill Material (2017, 2022 & 2028F)

Table 68: China Artificial Turf Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 69: Japan Artificial Turf Market Size and Forecast By Fiber Base Material (2017, 2022 & 2028F)

Table 70: Japan Artificial Turf Market Size and Forecast By End Users (2017, 2022 & 2028F)

Table 71: Japan Artificial Turf Market Size and Forecast By Infill Material (2017, 2022 & 2028F)

Table 72: Japan Artificial Turf Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 73: India Artificial Turf Market Size and Forecast By Fiber Base Material (2017, 2022 & 2028F)

Table 74: India Artificial Turf Market Size and Forecast By End Users (2017, 2022 & 2028F)

Table 75: India Artificial Turf Market Size and Forecast By Infill Material (2017, 2022 & 2028F)

Table 76: India Artificial Turf Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 77: Australia Artificial Turf Market Size and Forecast By Fiber Base Material (2017, 2022 & 2028F)

Table 78: Australia Artificial Turf Market Size and Forecast By End Users (2017, 2022 & 2028F)

Table 79: Australia Artificial Turf Market Size and Forecast By Infill Material (2017, 2022 & 2028F)

Table 80: Australia Artificial Turf Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 81: South Korea Artificial Turf Market Size and Forecast By Fiber Base Material (2017, 2022 & 2028F)

Table 82: South Korea Artificial Turf Market Size and Forecast By End Users (2017, 2022 & 2028F)

Table 83: South Korea Artificial Turf Market Size and Forecast By Infill Material (2017, 2022 & 2028F)

Table 84: South Korea Artificial Turf Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 85: South America Artificial Turf Market Size and Forecast By Fiber Base Material (2017 to 2028F) (In USD Million)

Table 86: South America Artificial Turf Market Size and Forecast By End Users (2017 to 2028F) (In USD Million)

Table 87: South America Artificial Turf Market Size and Forecast By Infill Material (2017 to 2028F) (In USD Million)

Table 88: South America Artificial Turf Market Size and Forecast By Distribution Channel (2017 to 2028F) (In USD Million)

Table 89: South America Artificial Turf Market Size and Forecast By Application (2017 to 2028F) (In USD Million)

Table 90: Brazil Artificial Turf Market Size and Forecast By Fiber Base Material (2017, 2022 & 2028F)

Table 91: Brazil Artificial Turf Market Size and Forecast By End Users (2017, 2022 & 2028F)

Table 92: Brazil Artificial Turf Market Size and Forecast By Infill Material (2017, 2022 & 2028F)

Table 93: Brazil Artificial Turf Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 94: Argentina Artificial Turf Market Size and Forecast By Fiber Base Material (2017, 2022 & 2028F)

Table 95: Argentina Artificial Turf Market Size and Forecast By End Users (2017, 2022 & 2028F)

Table 96: Argentina Artificial Turf Market Size and Forecast By Infill Material (2017, 2022 & 2028F)

Table 97: Argentina Artificial Turf Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 98: Columbia Artificial Turf Market Size and Forecast By Fiber Base Material (2017, 2022 & 2028F)

Table 99: Columbia Artificial Turf Market Size and Forecast By End Users (2017, 2022 & 2028F)

Table 100: Columbia Artificial Turf Market Size and Forecast By Infill Material (2017, 2022 & 2028F)

Table 101: Columbia Artificial Turf Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 102: Middle East & Africa Artificial Turf Market Size and Forecast By Fiber Base Material (2017 to 2028F) (In USD Million)

Table 103: Middle East & Africa Artificial Turf Market Size and Forecast By End Users (2017 to 2028F) (In USD Million)

Table 104: Middle East & Africa Artificial Turf Market Size and Forecast By Infill Material (2017 to 2028F) (In USD Million)

Table 105: Middle East & Africa Artificial Turf Market Size and Forecast By Distribution Channel (2017 to 2028F) (In USD Million)

Table 106: Middle East & Africa Artificial Turf Market Size and Forecast By Application (2017 to 2028F) (In USD Million)

Table 107: UAE Artificial Turf Market Size and Forecast By Fiber Base Material (2017, 2022 & 2028F)

Table 108: UAE Artificial Turf Market Size and Forecast By End Users (2017, 2022 & 2028F)

Table 109: UAE Artificial Turf Market Size and Forecast By Infill Material (2017, 2022 & 2028F)

Table 110: UAE Artificial Turf Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 111: Saudi Arabia Artificial Turf Market Size and Forecast By Fiber Base Material (2017, 2022 & 2028F)

Table 112: Saudi Arabia Artificial Turf Market Size and Forecast By End Users (2017, 2022 & 2028F)

Table 113: Saudi Arabia Artificial Turf Market Size and Forecast By Infill Material (2017, 2022 & 2028F)

Table 114: Saudi Arabia Artificial Turf Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 115: South Africa Artificial Turf Market Size and Forecast By Fiber Base Material (2017, 2022 & 2028F)

Table 116: South Africa Artificial Turf Market Size and Forecast By End Users (2017, 2022 & 2028F)

Table 117: South Africa Artificial Turf Market Size and Forecast By Infill Material (2017, 2022 & 2028F)

Table 118: South Africa Artificial Turf Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Figure 1: Global Artificial Turf Market Size (USD Million) By Region, 2022 & 2028

Figure 2: Market attractiveness Index, By Region 2028

Figure 3: Market attractiveness Index, By Segment 2028

Figure 4: Competitive Dashboard of top 5 players, 2022

Figure 5: Market Share insights of key players, 2022

Figure 6: Porter's Five Forces of Global Artificial Turf Market

Figure 7: Global Artificial Turf Market Size By Value (2017, 2022 & 2028F) (in USD Million)

Figure 8: Global Artificial Turf Market Share By Region (2022)

Figure 9: North America Artificial Turf Market Size By Value (2017, 2022 & 2028F) (in USD Million)

Figure 10: North America Artificial Turf Market Share By Country (2022)

Figure 11: US Artificial Turf Market Size By Value (2017, 2022 & 2028F) (in USD Million)

Figure 12: Canada Artificial Turf Market Size By Value (2017, 2022 & 2028F) (in USD Million)

Figure 13: Mexico Artificial Turf Market Size By Value (2017, 2022 & 2028F) (in USD Million)

Figure 14: Europe Artificial Turf Market Size By Value (2017, 2022 & 2028F) (in USD Million)

Figure 15: Europe Artificial Turf Market Share By Country (2022)

Figure 16: Germany Artificial Turf Market Size By Value (2017, 2022 & 2028F) (in USD Million)

Figure 17: UK Artificial Turf Market Size By Value (2017, 2022 & 2028F) (in USD Million)

Figure 18: France Artificial Turf Market Size By Value (2017, 2022 & 2028F) (in USD Million)

Figure 19: Italy Artificial Turf Market Size By Value (2017, 2022 & 2028F) (in USD Million)

Figure 20: Spain Artificial Turf Market Size By Value (2017, 2022 & 2028F) (in USD Million)

Figure 21: Russia Artificial Turf Market Size By Value (2017, 2022 & 2028F) (in USD Million)

Figure 22: Asia-Pacific Artificial Turf Market Size By Value (2017, 2022 & 2028F) (in USD Million)

Figure 23: Asia-Pacific Artificial Turf Market Share By Country (2022)

Figure 24: China Artificial Turf Market Size By Value (2017, 2022 & 2028F) (in USD Million)

Figure 25: Japan Artificial Turf Market Size By Value (2017, 2022 & 2028F) (in USD Million)

Figure 26: India Artificial Turf Market Size By Value (2017, 2022 & 2028F) (in USD Million)

Figure 27: Australia Artificial Turf Market Size By Value (2017, 2022 & 2028F) (in USD Million)

Figure 28: South Korea Artificial Turf Market Size By Value (2017, 2022 & 2028F) (in USD Million)

Figure 29: South America Artificial Turf Market Size By Value (2017, 2022 & 2028F) (in USD Million)

Figure 30: South America Artificial Turf Market Share By Country (2022)

Figure 31: Brazil Artificial Turf Market Size By Value (2017, 2022 & 2028F) (in USD Million)

Figure 32: Argentina Artificial Turf Market Size By Value (2017, 2022 & 2028F) (in USD Million)

Figure 33: Columbia Artificial Turf Market Size By Value (2017, 2022 & 2028F) (in USD Million)

Figure 34: Middle East & Africa Artificial Turf Market Size By Value (2017, 2022 & 2028F) (in USD Million)

Figure 35: Middle East & Africa Artificial Turf Market Share By Country (2022)

Figure 36: UAE Artificial Turf Market Size By Value (2017, 2022 & 2028F) (in USD Million)

Figure 37: Saudi Arabia Artificial Turf Market Size By Value (2017, 2022 & 2028F) (in USD Million)

Figure 38: South Africa Artificial Turf Market Size By Value (2017, 2022 & 2028F) (in USD Million)

Market Research FAQs

Related Reports

We are friendly and approachable, give us a call.

We are friendly and approachable, give us a call.