Featured Companies

- 1. Godrej & Boyce Manufacturing Company Limited

- 2. Midea Group Co Limited

- 3. Panasonic Corporation

- 4. Samsung Electronics Co., Limited

- 5. Siemens Limited

- 6. Faber S.P.A

- 7. LG Electronic

- 8. Robert Bosch GmbH

- 9. Techtronic Industries Co. Limited

- More...

Dishwashers are an essential kitchen appliance globally. It is a type of white goods that is commonly used to wash dishes in commercial and residential kitchens. A dishwasher is a mechanical device that automatically cleans dishware and cutlery. The mechanical dishwasher cleans utensils by spraying hot water at temperatures ranging from 45°C to 75°C, with lower temperatures used for delicate items. Automatic dishwashers use less energy and water than hand-washing dishes. Rise in personal disposable income, increase in health and hygiene awareness, busy and hectic lifestyle of consumers, increase in the number of small and medium-sized restaurants, growth of the tourism industry, increase in the number of women employed, and rise in popularity of eating-out culture are some of the major factors that exponentially contribute to the growth of the global dishwasher market. Furthermore, demand for technologically advanced appliances and luxury goods have propelled the global dishwasher market's growth. Furthermore, rising environmental concerns and people's preference for more environmentally friendly products are important factors influencing dishwasher manufacturers, who are innovating in sleek, water-saving machines. Companies are concentrating their efforts on next-generation dishwashers that use less energy and are equipped with advanced features such as the half-load option, which allows customers to load only the upper or lower rack.

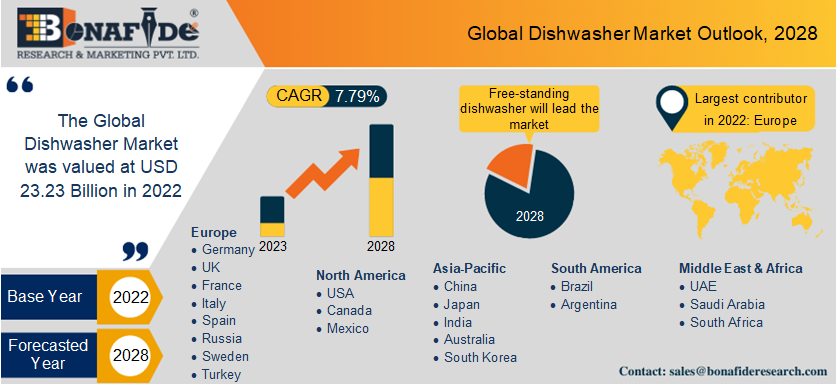

According to the research report, “Global Dishwasher Market Outlook, 2028”, published by Bonafide research the market is anticipated to reach USD 36.25 Billion by 2028 increasing from USD 23.23 Billion in 2022 with a CAGR of 7.79%. One of the major factors expected to drive the global growth of dishwashers is the changing lifestyle of consumers. Furthermore, rising adoption of connected home appliances, increasing popularity of the modular kitchen concept, higher per capita income level, and the growing impact of Western lifestyle are all expected to drive demand for various dishwashers around the world. The increase in the number of hotels, restaurants, cafes, catering services, and bars has fueled global demand for dishwashers. In addition to Customers prefer stainless-steel dishwashers because they require less maintenance. Stainless-steel products require lower wattage heat to dry, saving energy. Additionally, buyers prefer products with innovative features such as glass protection, shine enhancers, rinse aid, soundproofing, and LED touch panels. This innovation is expected to boost product demand. Moreover, Due to the events established by online merchants to drive sales through specialized promotions, such as on the occasion of Diwali, Christmas, and other important festivals, the online store-based segment is expected to grow faster in the market. Consumers are drawn to online store-based channels and accessible shopping experiences with simple return policies and payment options, which will fuel market growth throughout the forecast period.

What's Inside a Bonafide Research`s industry report?

A Bonafide Research industry report provides in-depth market analysis, trends, competitive insights, and strategic recommendations to help businesses make informed decisions.

Download Sample

Joel Houghton patented the first mechanical dishwasher in the United States in the 1850s. This device was a wooden box with a hand-turned wheel that splattered water on dishes. Dishwashers, however, did not become commercially available until the 1880s. An American socialite named Josephine Cochrane invented the first practical dishwasher in 1886. Cochrane's dishwasher was designed to clean dishes faster than her servants, who frequently chipped or broke her fine china. Her dishwasher was equipped with a motor that drove a copper boiler and spray arms that sprayed hot soapy water onto the dishes. Cochrane's dishwasher was a success, and she went on to found the KitchenAid Company. Dishwashers remained a luxury item for the wealthy in the early twentieth century. Dishwashers did not become more affordable and popular among the middle class until the 1950s. Manufacturers began experimenting with new designs and technologies, such as using steam and introducing plastic tubs. The introduction of built-in dishwashers, which were designed to be installed beneath kitchen counters, advanced dishwasher technology even further in the 1960s. These machines were smaller and more efficient than their predecessors, and they contributed to the widespread adoption of dishwashers in many American homes.

North America, Europe, Asia-Pacific, South America, the Middle East, and Africa account for the great majority of the global dishwasher market. Regionally, the Europe market is expected to account for the largest revenue share of the global dishwasher market in 2022, with a share of 39.26%. This is due to the widespread use of dishwashers in various commercial and residential sectors in European countries such as Germany, the United Kingdom, and Spain. Furthermore, a large consumer base is willing to purchase a dishwasher and increase household spending. Furthermore, the North America region is expected to grow at a significant rate due to the expansion of the manufacturing bases of prominent companies in Canada and the United States, such as GE Appliances, The Samsung Group, Robert Bosch GmbH, and others. This is likely to boost the consumption rate of dishwashers among the region's population. The growing preference for a hassle-free lifestyle in Asia-Pacific, as well as the growing industrial application of dishwashers, is supporting the region's dishwasher industry's growth. Significant changes in living standards, as well as increased urbanization, are taking place in developing countries such as China and Japan.

Based on product type, the global dishwasher market is segmented into two types: built-in and freestanding. Among these, freestanding models dominated the dishwasher market, accounting for more than 85% of the total. The ease of movement of freestanding products makes them popular among consumers. So even though freestanding products are easily movable, commercial customers prefer them. Customers benefit from extra storage space with freestanding products, and the top of the machine is typically coated with countertop materials or cutting boards. During the forecast period, the Built-in segment is expected to grow at the fastest CAGR. In general, built-in products have more features than freestanding products, such as specialized wash cycles, targeted sprays, and multiple spray arms. The growing popularity of modular kitchens is driving up demand for built-in kitchen appliances. Due to the increasing importance of compact and small houses, consumers place a premium on kitchen space and storage area planning. Continuous advancements, such as flexible interior layout, LED touch panels, push drawers, and a sleek appearance, have fueled demand for built-in products. Because of their automatic programmers and flexible interior arrangement features, wall-mounted and drawer-style built-in washers have grown in popularity in recent years.

Markets are divided into two categories based on application type: residential and commercial. In 2022, the residential application led the global dishwasher market. Household appliance penetration is expected to remain a key driver of growth. Changing lifestyles, as well as increased sanitation awareness, are expected to drive household demand for the product. Furthermore, rising spending on modular and designer kitchens will have a positive impact on the market. During the forecast period, the commercial application is expected to grow at the fastest rate, with a CAGR of more than 9%. Due to the product's ability to clean a large number of dishes and glassware efficiently, its use in commercial foodservice sectors such as restaurants, pubs, hotels, and cafés has grown significantly. Moreover, dishwashers have helped food services maintain the necessary cleanliness and hygiene to ensure an efficient service workflow.

The global dishwasher market can be divided into multi-brand stores, specialty stores, online stores, and others based on distribution channels. Multi-brand stores have the largest market share in the dishwasher market because they offer a diverse range of dishwashers from various brands, allowing customers to select from a diverse range of products. Customers can thus compare different brands and models and select the dishwasher that best meets their needs and budget. During the forecast period, the CAGR for the online channel is the highest. Furthermore, due to the increased internet penetration, ease and convenience of shopping, and increased popularity of online retail platforms such as eBay, Walmart, Amazon, Flipkart and others, online retail is expected to be the trending channel around the world.

Start-ups in the global dishwasher market that provide innovative solutions to the industry Here are some examples: Tetra is a start-up that has developed a compact, countertop dishwasher that can wash up to two place settings at a time. The dishwasher uses less water and energy than traditional dishwashers and can be controlled using a smartphone app. Furthermore, Heatworks has developed a dishwasher called the Tetra Countertop Dishwasher, which uses an innovative technology that heats water instantly to the correct temperature without the need for a heating element. The dishwasher is small enough to fit on a countertop and can wash up to 10 plates or 12 pint glasses at once. Moreover, OssDign is a Swedish start-up that has developed a 3D-printed ceramic implant technology for bone repair and regeneration. While not directly related to dishwashers, this technology can be used to create high-precision and durable components for dishwashers and other appliances. In addition to Kiverdi, there is a start-up that is developing a technology to convert carbon dioxide into high-value proteins and oils. This technology can be used to create sustainable materials for dishwashers and other appliances. In addition, TerraWash is a start-up that has created the TerraWash+Mg, a chemical-free, all-natural detergent alternative for dishwashers. This product uses magnesium to break down grease and food residue on dishes without the need for harsh chemicals.

Restraints:

In some cultures or regions, there may be a preference for traditional handwashing of dishes. This can make dishwashers less popular and limit market growth in these areas. Furthermore, Dishwashers require both water and energy to operate, which can lead to higher utility bills for consumers. In regions where water and energy costs are high, this can make dishwashers less attractive to consumers. Moreover, n smaller kitchens, there may be limited space to install a dishwasher, which can deter some consumers from purchasing one. This is particularly true in apartments and other small living spaces.

Opportunities:

Rapid technological advancements, such as the Internet of Things (IoT), artificial intelligence (AI), and smart home technologies, provide manufacturers with an opportunity to develop and market advanced dishwashers that provide greater convenience and efficiency. Furthermore, as people become more aware of the environmental impact of energy consumption and the need to reduce carbon footprint, there is a growing demand for energy-efficient appliances, including dishwashers. This gives manufacturers an opportunity to develop and market dishwashers that use less water and energy.

Trends:

Dishwashers that are connected and smart are becoming increasingly popular, allowing users to control and monitor their dishwashers remotely via smartphone apps. These dishwashers can also adjust their settings automatically based on the load, making them more energy-efficient. In addition, voice-activated control is becoming more popular in the dishwasher market, allowing users to control their dishwashers with voice commands. Furthermore, manufacturers are developing dishwashers with adjustable racks and loading options, allowing users to customise the interior to fit dishes of varying sizes and shapes.

Developments:

• Whirlpool introduced its new smart dishwasher model, the Whirlpool Smart All-In-One Care Washer and Dryer Combo, in 2021. This appliance is Wi-Fi enabled and can be controlled via a smartphone app.

• In 2021, Samsung released its new WaterWall dishwasher, which includes a new WaterWall cleaning system that uses a powerful vertical jet to clean dishes. The dishwasher is also Wi-Fi enabled and can be controlled via a smartphone app.

• In 2021, Bosch introduced its new 800 Series dishwasher, which includes new AutoAir technology that opens the dishwasher door automatically at the end of the cycle to improve drying performance. The dishwasher also has a new MyWay third rack for more loading options.

• Electrolux launched a new dishwasher line, the Electrolux ComfortLift dishwashers, in 2021. These dishwashers have a one-of-a-kind ComfortLift system that lifts the lower rack to a more comfortable height for loading and unloading.

• In 2021, LG released its new LG QuadWash dishwasher, which includes a new QuadWash cleaning system that uses four spray arms to provide thorough cleaning. The dishwasher is also Wi-Fi enabled and can be controlled via a smartphone app.

Covid-19

The pandemic caused significant disruptions to global supply chains, which impacted the production and distribution of dishwashers. Many factories were forced to shut down temporarily, leading to production delays and shortages of parts and components. Furthermore, with many brick-and-mortar stores forced to close during lockdowns, there has been a shift towards online sales of household appliances, including dishwashers. Online sales channels have become more important for both manufacturers and retailers in reaching consumers. Moreover, with more people staying at home during the pandemic, there has been a surge in demand for household appliances, including dishwashers. Consumers are also seeking out appliances with features that promote health and hygiene, such as high-temperature washing and sanitization cycles.

Major Companies present in the market:

Asko Appliances AB, Haier Group Corporation, Electrolux AB, Whirlpool Corporation, Robert Bosch GmbH, Miele & Cie, Arçelik AS, Samsung Electronics Co, LG Electronics Inc, Robam, Midea Group Co Ltd, Panasonic Corporation, Middleby Corporation, Techtronic Industries, Godrej & Boyce, Siemens AG, Sub ZeRo, Faber, Vantage Group (Vatti) , IFB Appliances.

Considered in this report

• Geography: Global

• Historic year: 2017

• Base year: 2022

• Estimated year: 2023

• Forecast year: 2028

Aspects covered in this report

• Global Dishwasher market with its value and forecast along with its segments

• Region-wise Dishwasher market analysis

• Various drivers and challenges

• On-going trends and developments

• Top profiled companies

• Strategic recommendation

Regions & Countries covered in the report:

• North America (United States, Canada, Mexico)

• Europe (Germany, France, Italy, UK, Spain, Russia, Sweden, Turkey)

• Asia-Pacific (China, Japan, India, Australia, South Korea)

• South America (Brazil, Argentina)

• Middle-East & Africa (UAE, Saudi Arabia, South Africa)

By Product Type:

• Built-in

• Free Standing

By Sales Channel:

• Multi-brans Stores

• Speciality Store

• Online

By Application Type:

• Residential

• Commercial

The approach of the report:

This report consists of a combined approach of primary as well as secondary research. Initially, secondary research was used to get an understanding of the market and list out the companies that are present in the market. The secondary research consists of third-party sources such as press releases, and annual reports of companies, analyzing the government-generated reports and databases. After gathering the data from secondary sources primary research was conducted by making telephonic interviews with the leading players about how the market is functioning and then conducting trade calls with dealers and distributors of the market. Post this we have started doing primary calls to consumers by equally segmenting consumers into regional aspects, tier aspects, age groups, and gender. Once we have primary data with us we started verifying the details obtained from secondary sources.

Intended audience

This report can be useful to industry consultants, manufacturers, suppliers, associations & organizations related to the Dishwasher industry, government bodies, and other stakeholders to align their market-centric strategies. In addition to marketing & presentations, it will also increase competitive knowledge about the industry.

Companies Mentioned

- Godrej & Boyce Manufacturing Company Limited

- Midea Group Co Limited

- Panasonic Corporation

- Samsung Electronics Co., Limited

- Siemens Limited

- Faber S.P.A

- LG Electronic

- Robert Bosch GmbH

- Techtronic Industries Co. Limited

- Whirlpool Corporation

- Electrolux

- ROBAM

- Arcelik AS

- Sub-Zero Group, Inc.

- Asko Appliances AB

- Haier Group Corporation

- Miele & Cie.

- Middleby Corporation

- Vantage Group (Vatti)

- IFB Appliances

Table of Contents

- Table of Content

- 1. Executive Summary

- 2. Market Dynamics

- 2.1. Market Drivers

- 2.2. Challenges

- 2.3. Opportunity

- 2.4. Restraints

- 2.5. Market Trends

- 2.6. Covid-19 Effect

- 2.7. Supply chain Analysis

- 2.8. Policy & Regulatory Framework

- 2.9. Industry Experts Views

- 3. Research Methodology

- 3.1. Secondary Research

- 3.2. Primary Data Collection

- 3.3. Market Formation & Validation

- 3.4. Report Writing, Quality Check & Delivery

- 4. Market Structure

- 4.1. Market Considerate

- 4.2. Assumptions

- 4.3. Limitations

- 4.4. Abbreviations

- 4.5. Sources

- 4.6. Definitions

- 5. Economic /Demographic Snapshot

- 6. Competitive Landscape

- 6.1. Competitive Dashboard

- 6.2. Business Strategies Adopted by Key Players

- 6.3. Key Players Market Share Insights and Analysis, 2022

- 6.4. Key Players Market Positioning Matrix

- 6.5. Consolidated SWOT Analysis of Key Players

- 6.6. Porter's Five Forces

- 7. Global Dishwasher Market Outlook

- 7.1. Market Size By Value

- 7.2. Market Size and Forecast, By Geography

- 7.3. Market Size and Forecast, By Product Type

- 7.4. Market Size and Forecast, By Application

- 7.5. Market Size and Forecast, By Distribution Channel

- 8. North America Dishwasher Market Outlook

- 8.1. Market Size By Value

- 8.2. Market Share By Country

- 8.3. Market Size and Forecast By Product Type

- 8.4. Market Size and Forecast By Application

- 8.5. Market Size and Forecast By Distribution Channel

- 8.6. US Dishwasher Market Outlook

- 8.6.1. Market Size By Value

- 8.6.2. Market Size and Forecast By Product Type

- 8.6.3. Market Size and Forecast By Application

- 8.6.4. Market Size and Forecast By Distribution Channel

- 8.7. Canada Dishwasher Market Outlook

- 8.7.1. Market Size By Value

- 8.7.2. Market Size and Forecast By Product Type

- 8.7.3. Market Size and Forecast By Application

- 8.7.4. Market Size and Forecast By Distribution Channel

- 8.8. Mexico Dishwasher Market Outlook

- 8.8.1. Market Size By Value

- 8.8.2. Market Size and Forecast By Product Type

- 8.8.3. Market Size and Forecast By Application

- 8.8.4. Market Size and Forecast By Distribution Channel

- 9. Europe Dishwasher Market Outlook

- 9.1. Market Size By Value

- 9.2. Market Share By Country

- 9.3. Market Size and Forecast By Product Type

- 9.4. Market Size and Forecast By Application

- 9.5. Market Size and Forecast By Distribution Channel

- 9.6. Germany Dishwasher Market Outlook

- 9.6.1. Market Size By Value

- 9.6.2. Market Size and Forecast By Product Type

- 9.6.3. Market Size and Forecast By Application

- 9.6.4. Market Size and Forecast By Distribution Channel

- 9.7. UK Dishwasher Market Outlook

- 9.7.1. Market Size By Value

- 9.7.2. Market Size and Forecast By Product Type

- 9.7.3. Market Size and Forecast By Application

- 9.7.4. Market Size and Forecast By Distribution Channel

- 9.8. France Dishwasher Market Outlook

- 9.8.1. Market Size By Value

- 9.8.2. Market Size and Forecast By Product Type

- 9.8.3. Market Size and Forecast By Application

- 9.8.4. Market Size and Forecast By Distribution Channel

- 9.9. Italy Dishwasher Market Outlook

- 9.9.1. Market Size By Value

- 9.9.2. Market Size and Forecast By Product Type

- 9.9.3. Market Size and Forecast By Application

- 9.9.4. Market Size and Forecast By Distribution Channel

- 9.10. Spain Dishwasher Market Outlook

- 9.10.1. Market Size By Value

- 9.10.2. Market Size and Forecast By Product Type

- 9.10.3. Market Size and Forecast By Application

- 9.10.4. Market Size and Forecast By Distribution Channel

- 9.11. Russia Dishwasher Market Outlook

- 9.11.1. Market Size By Value

- 9.11.2. Market Size and Forecast By Product Type

- 9.11.3. Market Size and Forecast By Application

- 9.11.4. Market Size and Forecast By Distribution Channel

- 9.12. Sweden Dishwasher Market Outlook

- 9.12.1. Market Size By Value

- 9.12.2. Market Size and Forecast By Product Type

- 9.12.3. Market Size and Forecast By Application

- 9.12.4. Market Size and Forecast By Distribution Channel

- 9.13. Turkey Dishwasher Market Outlook

- 9.13.1. Market Size By Value

- 9.13.2. Market Size and Forecast By Product Type

- 9.13.3. Market Size and Forecast By Application

- 9.13.4. Market Size and Forecast By Distribution Channel

- 10. Asia-Pacific Dishwasher Market Outlook

- 10.1. Market Size By Value

- 10.2. Market Share By Country

- 10.3. Market Size and Forecast By Product Type

- 10.4. Market Size and Forecast By Application

- 10.5. Market Size and Forecast By Distribution Channel

- 10.6. China Dishwasher Market Outlook

- 10.6.1. Market Size By Value

- 10.6.2. Market Size and Forecast By Product Type

- 10.6.3. Market Size and Forecast By Application

- 10.6.4. Market Size and Forecast By Distribution Channel

- 10.7. Japan Dishwasher Market Outlook

- 10.7.1. Market Size By Value

- 10.7.2. Market Size and Forecast By Product Type

- 10.7.3. Market Size and Forecast By Application

- 10.7.4. Market Size and Forecast By Distribution Channel

- 10.8. India Dishwasher Market Outlook

- 10.8.1. Market Size By Value

- 10.8.2. Market Size and Forecast By Product Type

- 10.8.3. Market Size and Forecast By Application

- 10.8.4. Market Size and Forecast By Distribution Channel

- 10.9. Australia Dishwasher Market Outlook

- 10.9.1. Market Size By Value

- 10.9.2. Market Size and Forecast By Product Type

- 10.9.3. Market Size and Forecast By Application

- 10.9.4. Market Size and Forecast By Distribution Channel

- 10.10. South Korea Dishwasher Market Outlook

- 10.10.1. Market Size By Value

- 10.10.2. Market Size and Forecast By Product Type

- 10.10.3. Market Size and Forecast By Application

- 10.10.4. Market Size and Forecast By Distribution Channel

- 11. South America Dishwasher Market Outlook

- 11.1. Market Size By Value

- 11.2. Market Share By Country

- 11.3. Market Size and Forecast By Product Type

- 11.4. Market Size and Forecast By Application

- 11.5. Market Size and Forecast By Distribution Channel

- 11.6. Brazil Dishwasher Market Outlook

- 11.6.1. Market Size By Value

- 11.6.2. Market Size and Forecast By Product Type

- 11.6.3. Market Size and Forecast By Application

- 11.6.4. Market Size and Forecast By Distribution Channel

- 11.7. Argentina Dishwasher Market Outlook

- 11.7.1. Market Size By Value

- 11.7.2. Market Size and Forecast By Product Type

- 11.7.3. Market Size and Forecast By Application

- 11.7.4. Market Size and Forecast By Distribution Channel

- 12. Middle East & Africa Dishwasher Market Outlook

- 12.1. Market Size By Value

- 12.2. Market Share By Country

- 12.3. Market Size and Forecast By Product Type

- 12.4. Market Size and Forecast By Application

- 12.5. Market Size and Forecast By Distribution Channel

- 12.6. UAE Dishwasher Market Outlook

- 12.6.1. Market Size By Value

- 12.6.2. Market Size and Forecast By Product Type

- 12.6.3. Market Size and Forecast By Application

- 12.6.4. Market Size and Forecast By Distribution Channel

- 12.7. Saudi Arabia Dishwasher Market Outlook

- 12.7.1. Market Size By Value

- 12.7.2. Market Size and Forecast By Product Type

- 12.7.3. Market Size and Forecast By Application

- 12.7.4. Market Size and Forecast By Distribution Channel

- 12.8. South Africa Dishwasher Market Outlook

- 12.8.1. Market Size By Value

- 12.8.2. Market Size and Forecast By Product Type

- 12.8.3. Market Size and Forecast By Application

- 12.8.4. Market Size and Forecast By Distribution Channel

- 13. Company Profile

- 13.1. Asko Appliances AB

- 13.1.1. Company Snapshot

- 13.1.2. Company Overview

- 13.1.3. Financial Highlights

- 13.1.4. Geographic Insights

- 13.1.5. Business Segment & Performance

- 13.1.6. Product Portfolio

- 13.1.7. Key Executives

- 13.1.8. Strategic Moves & Developments

- 13.2. Haier Group Corporation

- 13.3. Electrolux AB

- 13.4. Whirlpool Corporation

- 13.5. Robert Bosch GmbH

- 13.6. Miele & Cie.

- 13.7. Arçelik AS

- 13.8. Samsung Electronics Co.

- 13.9. LG Electronics Inc

- 13.10. Robam

- 13.11. Midea Group Co Ltd

- 13.12. Panasonic Corporation

- 13.13. Middleby Corporation

- 13.14. Techtronic Industries

- 13.15. Godrej & Boyce Mfg

- 13.16. Siemens AG

- 13.17. Sub ZeRo

- 13.18. Faber

- 13.19. Vantage Group (Vatti)

- 13.20. IFB Appliances

- 14. Strategic Recommendations

- 15. Annexure

- 15.1. FAQ`s

- 15.2. Notes

- 15.3. Related Reports

- 16. Disclaimer

Table 1 : Global Dishwasher Market Snapshot, By Segmentation (2022 & 2028) (in USD Billion)

Table 2 : Influencing Factors for Global Dishwasher Market, 2022

Table 3: Top 10 Counties Economic Snapshot 2020

Table 4: Economic Snapshot of Other Prominent Countries 2020

Table 5: Average Exchange Rates for Converting Foreign Currencies into U.S. Dollars

Table 6: Global Dishwasher Market Size and Forecast, By Geography (2017 to 2028F) (In USD Billion)

Table 7: Global Dishwasher Market Size and Forecast, By Product Type (2017 to 2028F) (In USD Billion)

Table 8: Global Dishwasher Market Size and Forecast, By Application (2017 to 2028F) (In USD Billion)

Table 9: Global Dishwasher Market Size and Forecast, By Distribution Channel (2017 to 2028F) (In USD Billion)

Table 10: North America Dishwasher Market Size and Forecast By Product Type (2017 to 2028F) (In USD Billion)

Table 11: North America Dishwasher Market Size and Forecast By Application (2017 to 2028F) (In USD Billion)

Table 12 : North America Dishwasher Market Size and Forecast By Distribution Channel (2017 to 2028F) (In USD Billion)

Table 13 : US Dishwasher Market Size and Forecast By Product Type (2017, 2022 & 2028F)

Table 14 : US Dishwasher Market Size and Forecast By Application (2017, 2022 & 2028F)

Table 15 : US Dishwasher Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 16 : Canada Dishwasher Market Size and Forecast By Product Type (2017, 2022 & 2028F)

Table 17 : Canada Dishwasher Market Size and Forecast By Application (2017, 2022 & 2028F)

Table 18 : Canada Dishwasher Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 19 : Mexico Dishwasher Market Size and Forecast By Product Type (2017, 2022 & 2028F)

Table 20 : Mexico Dishwasher Market Size and Forecast By Application (2017, 2022 & 2028F)

Table 21 : Mexico Dishwasher Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 22 : Europe Dishwasher Market Size and Forecast By Product Type (2017 to 2028F) (In USD Billion)

Table 23 : Europe Dishwasher Market Size and Forecast By Application (2017 to 2028F) (In USD Billion)

Table 24 : Europe Dishwasher Market Size and Forecast By Distribution Channel (2017 to 2028F) (In USD Billion)

Table 25 : Germany Dishwasher Market Size and Forecast By Product Type (2017, 2022 & 2028F)

Table 26 : Germany Dishwasher Market Size and Forecast By Application (2017, 2022 & 2028F)

Table 27 : Germany Dishwasher Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 28 : UK Dishwasher Market Size and Forecast By Product Type (2017, 2022 & 2028F)

Table 29 : UK Dishwasher Market Size and Forecast By Application (2017, 2022 & 2028F)

Table 30 : UK Dishwasher Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 31 : France Dishwasher Market Size and Forecast By Product Type (2017, 2022 & 2028F)

Table 32 : France Dishwasher Market Size and Forecast By Application (2017, 2022 & 2028F)

Table 33 : France Dishwasher Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 34 : Italy Dishwasher Market Size and Forecast By Product Type (2017, 2022 & 2028F)

Table 35 : Italy Dishwasher Market Size and Forecast By Application (2017, 2022 & 2028F)

Table 36 : Italy Dishwasher Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 37 : Spain Dishwasher Market Size and Forecast By Product Type (2017, 2022 & 2028F)

Table 38 : Spain Dishwasher Market Size and Forecast By Application (2017, 2022 & 2028F)

Table 39 : Spain Dishwasher Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 40 : Russia Dishwasher Market Size and Forecast By Product Type (2017, 2022 & 2028F)

Table 41 : Russia Dishwasher Market Size and Forecast By Application (2017, 2022 & 2028F)

Table 42 : Russia Dishwasher Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 43 : Sweden Dishwasher Market Size and Forecast By Product Type (2017, 2022 & 2028F)

Table 44 : Sweden Dishwasher Market Size and Forecast By Application (2017, 2022 & 2028F)

Table 45 : Sweden Dishwasher Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 46 : Turkey Dishwasher Market Size and Forecast By Product Type (2017, 2022 & 2028F)

Table 47 : Turkry Dishwasher Market Size and Forecast By Application (2017, 2022 & 2028F)

Table 48 : Turkey Dishwasher Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 49 : Asia-Pacific Dishwasher Market Size and Forecast By Product Type (2017 to 2028F) (In USD Billion)

Table 50 : Asia-Pacific Dishwasher Market Size and Forecast By Application (2017 to 2028F) (In USD Billion)

Table 51 : Asia-Pacific Dishwasher Market Size and Forecast By Distribution Channel (2017 to 2028F) (In USD Billion)

Table 52 : China Dishwasher Market Size and Forecast By Product Type (2017, 2022 & 2028F)

Table 53 : China Dishwasher Market Size and Forecast By Application (2017, 2022 & 2028F)

Table 54 : China Dishwasher Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 55 : Japan Dishwasher Market Size and Forecast By Product Type (2017, 2022 & 2028F)

Table 56 : Japan Dishwasher Market Size and Forecast By Application (2017, 2022 & 2028F)

Table 57 : Japan Dishwasher Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 58 : India Dishwasher Market Size and Forecast By Product Type (2017, 2022 & 2028F)

Table 59 : India Dishwasher Market Size and Forecast By Application (2017, 2022 & 2028F)

Table 60 : India Dishwasher Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 61 : Australia Dishwasher Market Size and Forecast By Product Type (2017, 2022 & 2028F)

Table 62 : Australia Dishwasher Market Size and Forecast By Application (2017, 2022 & 2028F)

Table 63 : Australia Dishwasher Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 64 : South Korea Dishwasher Market Size and Forecast By Product Type (2017, 2022 & 2028F)

Table 65 : South Korea Dishwasher Market Size and Forecast By Application (2017, 2022 & 2028F)

Table 66 : South Korea Dishwasher Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 67 : South America Dishwasher Market Size and Forecast By Product Type (2017 to 2028F) (In USD Billion)

Table 68 : South America Dishwasher Market Size and Forecast By Application (2017 to 2028F) (In USD Billion)

Table 69 : South America Dishwasher Market Size and Forecast By Distribution Channel (2017 to 2028F) (In USD Billion)

Table 70 : Brazil Dishwasher Market Size and Forecast By Product Type (2017, 2022 & 2028F)

Table 71 : Brazil Dishwasher Market Size and Forecast By Application (2017, 2022 & 2028F)

Table 72 : Brazil Dishwasher Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 73 : Argentina Dishwasher Market Size and Forecast By Product Type (2017, 2022 & 2028F)

Table 74 : Argentina Dishwasher Market Size and Forecast By Application (2017, 2022 & 2028F)

Table 75 : Argentina Dishwasher Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 76 : Middle East & Africa Dishwasher Market Size and Forecast By Product Type (2017 to 2028F) (In USD Billion)

Table 77 : Middle East & Africa Dishwasher Market Size and Forecast By Application (2017 to 2028F) (In USD Billion)

Table 78 : Middle East & Africa Dishwasher Market Size and Forecast By Distribution Channel (2017 to 2028F) (In USD Billion)

Table 79 : UAE Dishwasher Market Size and Forecast By Product Type (2017, 2022 & 2028F)

Table 80 : UAE Dishwasher Market Size and Forecast By Application (2017, 2022 & 2028F)

Table 81 : UAE Dishwasher Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 82 : Saudi Arabia Dishwasher Market Size and Forecast By Product Type (2017, 2022 & 2028F)

Table 83 : Saudi Arabia Dishwasher Market Size and Forecast By Application (2017, 2022 & 2028F)

Table 84 : Saudi Arabia Dishwasher Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)

Table 85 : South Africa Dishwasher Market Size and Forecast By Product Type (2017, 2022 & 2028F)

Table 86 : South Africa Dishwasher Market Size and Forecast By Application (2017, 2022 & 2028F)

Table 87 : South Africa Dishwasher Market Size and Forecast By Distribution Channel (2017, 2022 & 2028F)?

Figure 1: Global Dishwasher Market Size (USD Billion) By Region, 2022 & 2028

Figure 2: Market attractiveness Index, By Region 2028

Figure 3: Market attractiveness Index, By Segment 2028

Figure 4: Competitive Dashboard of top 5 players, 2022

Figure 5: Market Share insights of key players, 2022

Figure 6: Porter's Five Forces of Global Dishwasher Market

Figure 7: Global Dishwasher Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 8: Global Dishwasher Market Share By Region (2022)

Figure 9: North America Dishwasher Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 10: North America Dishwasher Market Share By Country (2022)

Figure 11: US Dishwasher Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 12: Canada Dishwasher Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 13: Mexico Dishwasher Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 14: Europe Dishwasher Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 15: Europe Dishwasher Market Share By Country (2022)

Figure 16: Germany Dishwasher Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 17: UK Dishwasher Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 18: France Dishwasher Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 19: Italy Dishwasher Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 20: Spain Dishwasher Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 21: Russia Dishwasher Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 22: Sweden Dishwasher Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 23: Turkey Dishwasher Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 24: Asia-Pacific Dishwasher Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 25: Asia-Pacific Dishwasher Market Share By Country (2022)

Figure 26: China Dishwasher Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 27: Japan Dishwasher Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 28: India Dishwasher Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 29: Australia Dishwasher Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 30: South Korea Dishwasher Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 31: South America Dishwasher Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 32: South America Dishwasher Market Share By Country (2022)

Figure 33: Brazil Dishwasher Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 34: Argentina Dishwasher Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 35: Middle East & Africa Dishwasher Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 36: Middle East & Africa Dishwasher Market Share By Country (2022)

Figure 37: UAE Dishwasher Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 38: Saudi Arabia Dishwasher Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 39: South Africa Dishwasher Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Market Research FAQs

Related Reports

We are friendly and approachable, give us a call.

We are friendly and approachable, give us a call.